All Categories

Featured

Table of Contents

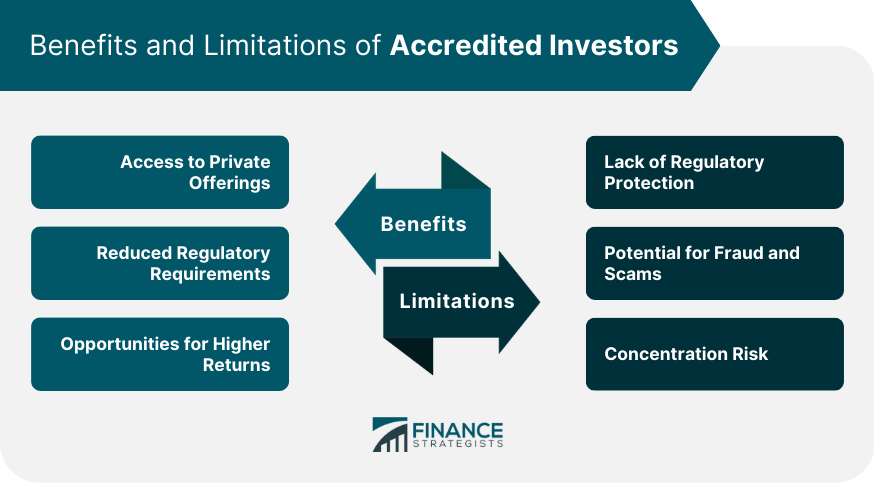

These investments can have greater prices of return, much better diversity, and lots of other qualities that assist develop wide range, and most importantly, build riches in a much shorter amount of time. Among the easiest instances of the advantage of being an approved financier is being able to invest in hedge funds. Hedge funds are largely only easily accessible to certified capitalists since they call for high minimum investment quantities and can have higher affiliated risks however their returns can be extraordinary.

There are also disadvantages to being a recognized investor that relate to the investments themselves. Many investments that call for an individual to be a recognized capitalist included high danger (accredited investor property investment deals). The approaches utilized by several funds included a greater threat in order to accomplish the objective of defeating the marketplace

Simply transferring a couple of hundred or a couple of thousand dollars right into an investment will certainly refrain. Recognized financiers will certainly have to commit to a few hundred thousand or a couple of million bucks to take part in financial investments indicated for accredited capitalists. If your financial investment goes southern, this is a whole lot of cash to shed.

Most Affordable Accredited Investor Real Estate Investment Networks

These largely come in the form of efficiency costs in enhancement to administration fees. Performance charges can vary in between 15% to 20%. One more con to being a recognized capitalist is the capability to access your investment capital. If you acquire a few supplies online with a digital platform, you can draw that cash out any kind of time you like.

Being a certified capitalist comes with a whole lot of illiquidity. They can additionally ask to evaluate your: Financial institution and other account statementsCredit reportW-2 or various other incomes statementsTax returnsCredentials released by the Financial Sector Regulatory Authority (FINRA), if any kind of These can help a firm figure out both your monetary qualifications and your sophistication as a capitalist, both of which can impact your condition as a certified investor.

A financial investment car, such as a fund, would certainly have to determine that you certify as an accredited capitalist. The benefits of being an accredited investor consist of access to one-of-a-kind financial investment chances not available to non-accredited investors, high returns, and raised diversity in your profile.

Unparalleled Accredited Investor Secured Investment Opportunities

In certain areas, non-accredited financiers likewise have the right to rescission. What this suggests is that if an investor determines they desire to take out their money early, they can claim they were a non-accredited capitalist during and get their cash back. However, it's never ever an excellent concept to provide falsified files, such as fake income tax return or monetary declarations to a financial investment vehicle simply to invest, and this could bring legal difficulty for you down the line - accredited investor financial growth opportunities.

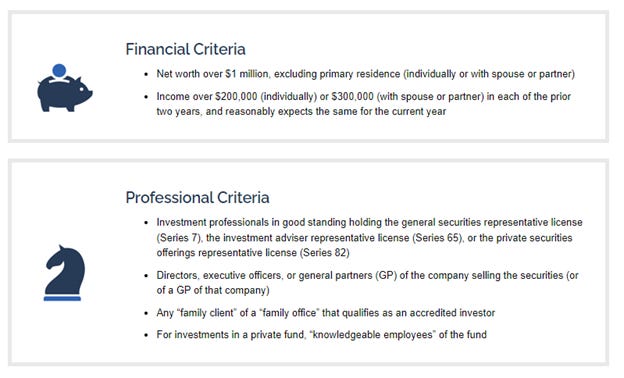

That being claimed, each deal or each fund may have its own limitations and caps on financial investment amounts that they will certainly approve from an investor. Accredited capitalists are those that satisfy certain demands pertaining to revenue, qualifications, or net worth.

Sought-After Accredited Investor Passive Income Programs

Over the past several years, the certified capitalist interpretation has been criticized on the basis that its sole concentrate on an asset/income test has unfairly omitted just about the most affluent individuals from lucrative investment opportunities. In feedback, the SEC started thinking about methods to increase this meaning. After a comprehensive remark duration, the SEC adopted these amendments as a means both to catch individuals that have trustworthy, different indicators of economic elegance and to update specific out-of-date portions of the meaning.

The SEC's main problem in its regulation of unregistered protections offerings is the defense of those capitalists that lack an enough level of economic refinement. This problem does not put on knowledgeable staff members since, by the nature of their placement, they have enough experience and access to financial information to make enlightened investment choices.

The identifying factor is whether a non-executive worker actually takes part in the private investment firm's investments, which must be identified on a case-by-case basis. The enhancement of knowledgeable staff members to the accredited financier interpretation will likewise allow more employees to purchase their employer without the personal financial investment business risking its very own standing as a certified capitalist.

Next-Level Private Equity For Accredited Investors

Prior to the changes, some exclusive investment firm ran the risk of losing their recognized financier standing if they permitted their employees to purchase the firm's offerings. Under the amended meaning, a higher number of personal investment firm staff members will certainly currently be eligible to invest. This not only produces an added source of funding for the personal investment firm, however likewise further lines up the interests of the worker with their employer.

Presently, just individuals holding certain broker or economic consultant licenses ("Collection 7, Collection 65, and Collection 82") qualify under the definition, however the amendments approve the SEC the capacity to include extra certifications, classifications, or credentials in the future. Particular kinds of entities have likewise been contributed to the interpretation.

The addition of LLCs is most likely one of the most significant enhancement. When the interpretation was last updated in 1989, LLCs were reasonably uncommon and were not consisted of as a qualified entity. Since that time, LLCs have actually come to be very common, and the meaning has actually been updated to mirror this. Under the amendments, an LLC is thought about an approved capitalist when (i) it has at least $5,000,000 in possessions and (ii) it has not been developed entirely for the details objective of getting the safety and securities provided.

In a similar way, specific household offices and their clients have actually been contributed to the meaning. A "family office" is an entity that is developed by a family members to manage its properties and attend to its future. To ensure that these entities are covered by the interpretation, the changes mention that a family members office will currently certify as an approved investor when it (i) manages a minimum of $5,000,000 in properties, (ii) has actually not been formed especially for the purpose of obtaining the offered protections, and (iii) is directed by an individual that has the monetary refinement to assess the qualities and dangers of the offering.

All-In-One Accredited Investor Real Estate Deals for Accredited Investment Portfolios

The SEC requested comments regarding whether the financial thresholds for the revenue and asset tests in the interpretation need to be readjusted. These limits have remained in place since 1982 and have actually not been gotten used to account for rising cost of living or various other factors that have transformed in the stepping in 38 years. However, the SEC eventually made a decision to leave the property and earnings limits unmodified in the meantime. private placements for accredited investors.

Please allow us understand if we can be useful. To check out the original alert, please visit this site.

Latest Posts

Tax Foreclosure Listings Free

Back Taxes Property For Sale

How Do You Invest In Tax Liens